Annuity Payout Options A Simple Guide

Explore various annuity payout choices, including lifetime income, helping you understand each for informed decisions.

Research topics

Understanding Annuity Payouts

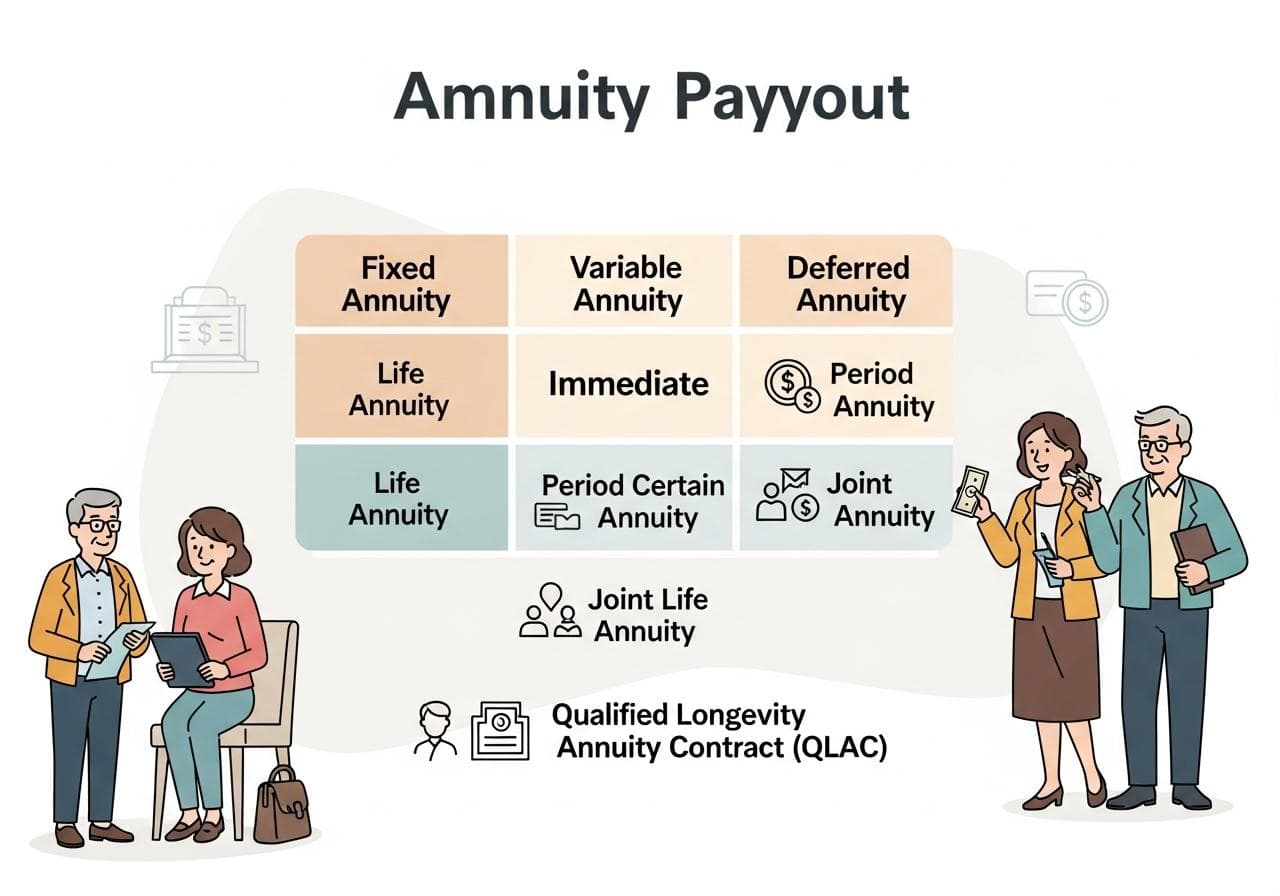

When it comes to planning for your financial future, understanding Annuity Payout options can be a game changer. An annuity payout is the distribution method that allows you to withdraw money from your annuity investment. There are various types of annuities, from Fixed Annuities to Variable Annuities. This guide will break down the most common annuity payout options available, so you can make an informed decision.

Types of Annuities

Before diving into payout options, it’s crucial to understand the various types of annuities. The most significant categories are Immediate Annuities and Deferred Annuities. Immediate annuities start payments right away, whereas deferred annuities allow for a waiting period before withdrawals can begin. Both have their benefits, and your choice should align with your financial needs.

What is a Period Certain Annuity?

A Period Certain Annuity is designed to pay out benefits for a specified period, regardless of whether the annuitant is alive or not. This feature makes it a popular choice for people looking to secure income for a guaranteed timeframe. If the annuitant passes away before the end of the period, the remaining payments will be passed on to the beneficiaries.

Choosing Between Fixed and Variable Annuities

When selecting an annuity, you need to consider whether a Fixed Annuity or a Variable Annuity fits your financial goals. Fixed annuities provide a guaranteed payout amount, making them a stable choice for conservative investors. On the other hand, variable annuities offer the potential for higher returns by allowing you to invest in various portfolios, but with that comes greater risk.

Immediate vs. Deferred Annuities

Understanding the difference between Immediate Annuities and Deferred Annuities is crucial for your planning. Immediate annuities begin payouts right after the initial investment, while deferred annuities let your investment grow for a specified time before you start receiving payments. Your choice here will largely rely on your current financial situation and future income needs.

Exploring Income Annuities

Income Annuities are designed to provide steady income throughout your retirement. They can be set up in various ways including single premium immediate annuities or joint life annuities, each catering to different needs. For instance, a Joint Life Annuity ensures that two individuals—such as spouses—will receive payments for as long as one of them is alive.

Longevity Annuities: Planning for the Long Haul

A Longevity Annuity is an excellent option for those looking to plan for later stages in retirement. This type of annuity starts payments later in life, helping individuals ensure they do not outlive their savings. Besides, a Qualified Longevity Annuity Contract (QLAC) can be included within retirement accounts to optimize tax benefits while providing ongoing income.

Understanding the Single Premium Immediate Annuity

A Single Premium Immediate Annuity is another straightforward option for generating income right away. By making a one-time payment, you can begin receiving regular payouts immediately. This can be an excellent solution for retirees looking for guaranteed income soon after retirement, aiding with budgeting and expenses.

The Importance of a Life Annuity

A Life Annuity pays out for the entirety of the annuitant's life, which is particularly beneficial for those seeking financial security in retirement. This form ensures that you'll have a continuous income for as long as you live, thereby reducing the risk of outliving your retirement savings.

Finding the Right Annuity Payout Option for You

With so many payout options available, how do you choose the right one? It’s essential to consider your financial goals, amount of savings, and how long you anticipate needing the payouts. Consulting with a financial advisor can also help clarify these options. For an in-depth overview of all the available annuity payout options, check out this comprehensive guide at Annuity.org.

Final Thoughts

Understanding the intricacies of annuity payouts is essential for anyone looking to secure their financial future. From Fixed Annuities to Period Certain Annuities, each type has its unique benefits depending on your circumstances. By weighing your options carefully, you can ensure your retirement is as comfortable and secure as possible.

For more information about payout annuities, visit Sun Life Global Investments and explore the ideal solutions that fit your financial journey.

Posts Relacionados

$150000 Life Insurance

Life insurance provides a lump sum payment to beneficiaries upon death of the insured.

0 Balance Transfer Cards Reviewed

This article reviews zero balance transfer cards, offering valuable insights for consumers.

0% Balance Transfer Cards Reviewed

This article reviews credit cards offering zero percent balance transfers, analyzing benefits and drawbacks for consumers.