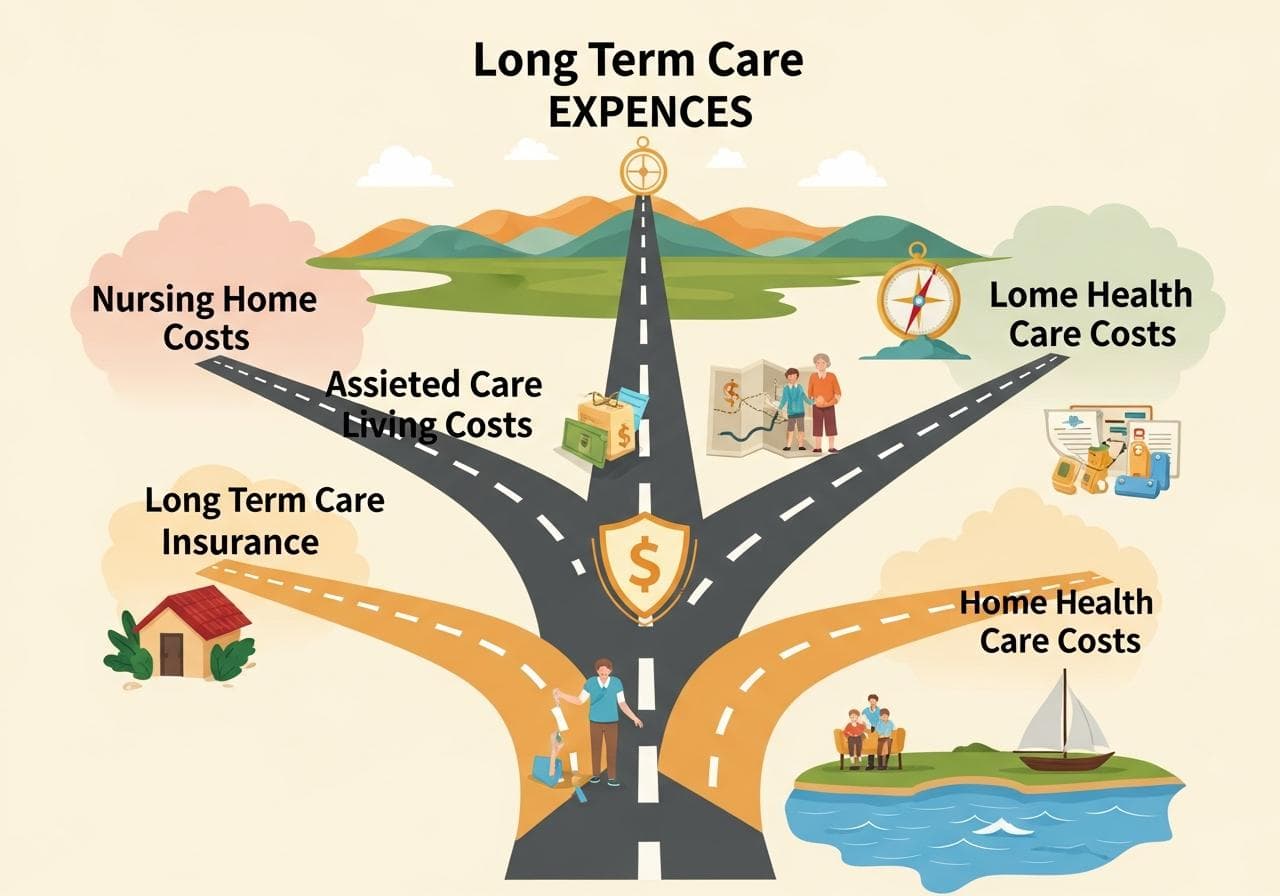

Navigating Long Term Care Costs

Long-term care expenses often present financial challenges. Planning can help manage these substantial, future costs effectively.

Research topics

Navigating the landscape of Long Term Care Costs can be daunting, especially when planning for the future of ourselves and our loved ones. From nursing homes to home healthcare, the expenses can accumulate rapidly, leading to financial stress in later years. Popular options include Nursing Home Costs, Assisted Living Costs, and Home Health Care Costs. Understanding these options and what they entail is crucial for long-term planning.

Understanding Long Term Care Costs

Long Term Care Costs can vary significantly based on the type of care needed and the setting in which it is provided. For instance, a typical skilled nursing facility may have substantially different rates compared to an assisted living community or in home health care. The national average for a nursing home in the United States can be upwards of $100,000 annually, while assisted living facilities might average around $48,000 per year. To get a comprehensive view of these costs, resources like CareScout offer valuable insights into regional differences and service options.

The Different Types of Care

When assessing Long Term Care Costs, it's essential to understand the types of care available. For example, a Skilled Nursing Facility provides intense medical care and supervision, often required after major surgery or health events. In contrast, Memory Care Costs are specifically tailored for individuals dealing with dementia or other memory-related conditions and can add an additional layer to overall care expenses.

Additionally, there are options such as Continuing Care Retirement Communities (CCRCs), which offer a mix of services from independent living to nursing care. This type of community is designed for seniors who want to age in place without having to move as their needs change, but they come with their own set of costs that can be less predictable than other care options.

The Role of Insurance and Medicaid

Financial planning for Long Term Care Costs often includes exploring Long Term Care Insurance. This type of insurance can provide a safety net for those who want to minimize out-of-pocket expenses associated with long-term care. However, it’s essential to understand that not all policies cover all services, and costs can differ based on individual health, age, and chosen coverage levels.

Another option is Medicaid for Long Term Care. Medicaid can cover some costs for those who meet qualifying criteria based on income and resources. Understanding how Medicaid interacts with your finances, including any potential impact on inheritances and how it affects other assets like Special Needs Trusts, can help gauge the overall financial picture. For more practical advice, check out Schwab's guide on managing these costs.

Home Health Care Costs

For many, Home Health Care Costs may seem more appealing. Home care allows individuals to maintain their independence while receiving necessary healthcare services in a familiar environment. However, these services can add up—most in-home health aides charge between $25 to $50 an hour, depending on the complexity of care required, leading to substantial monthly costs.

As part of the Long Term Care Planning process, families must evaluate whether home care is a financially sustainable option compared to other settings. Understanding available financial support or assistance—as well as conducting a thorough hunt for the right agency—can ease the burden somewhat.

The Importance of Long Term Care Planning

Implementing a solid Long Term Care Planning strategy is critical. Families often wait too long to start this process, leading to challenges in making the right decisions when the time comes. Engaging with financial planners or elder care specialists can help navigate these complexities and develop a comprehensive strategy that considers all aspects of care, from Elder Care Costs to anticipated needs over time.

Deciding early on the right options, whether that’s investing in Long Term Care Insurance or assessing eligibility for Medicaid for Long Term Care, can mitigate future financial strain and facilitate a smoother transition into the necessary care as needs evolve.

Special Needs Trusts: Essential for Planning

One crucial tool in long-term care planning is the establishment of Special Needs Trusts. These trusts are especially beneficial for individuals with disabilities, ensuring they can still qualify for essential government benefits while also preserving some assets for their care. Understanding how to set up a special needs trust is vital for families, as it can safeguard loved ones' financial futures while maintaining their eligibility for benefits like Medicaid.

Incorporating special needs trusts into a long-term care plan can help relieve financial burdens, providing peace of mind that adequate support will be in place when it’s needed most.

Hidden Costs of Long Term Care

Diving into Long Term Care Costs often reveals hidden fees that families may not anticipate. For instance, many communities and agencies have added charges for services that can quickly inflate a monthly bill. Expenses like transportation, specialized therapies, or personal care items can be overlooked but should be carefully accounted for in any budgeting process.

Therefore, it’s crucial for families to ask detailed questions and request clear breakdowns of costs from providers—doing so can offer much-needed clarity and prepare families for what is genuinely involved in their care journey.

Conclusion: Preparing for the Future

As the reality of aging sets in, understanding and planning for Long Term Care Costs, Nursing Home Costs, and the expenses associated with home care becomes increasingly important. An informed approach will not only protect financial resources but also ensure that loved ones receive the care they need, when they need it, without excessive stress or complications.

For those wanting more information on typical costs and planning insights, the government resource at LTCFEDS can provide you with additional data to fuel your planning discussions. Start today, and secure peace of mind for tomorrow.

Posts Relacionados

4Patriots Incentive For Seniors 2024

Discover significant savings on emergency preparedness supplies with senior-specific discounts.

A Guide For Families Into Memory Care

This guide helps families understand and navigate the challenges of memory care for loved ones.

Aarp Member Incentive On Notary Services

AARP members can save money on notary services, a valuable benefit for those who frequently need to have documents notarized.