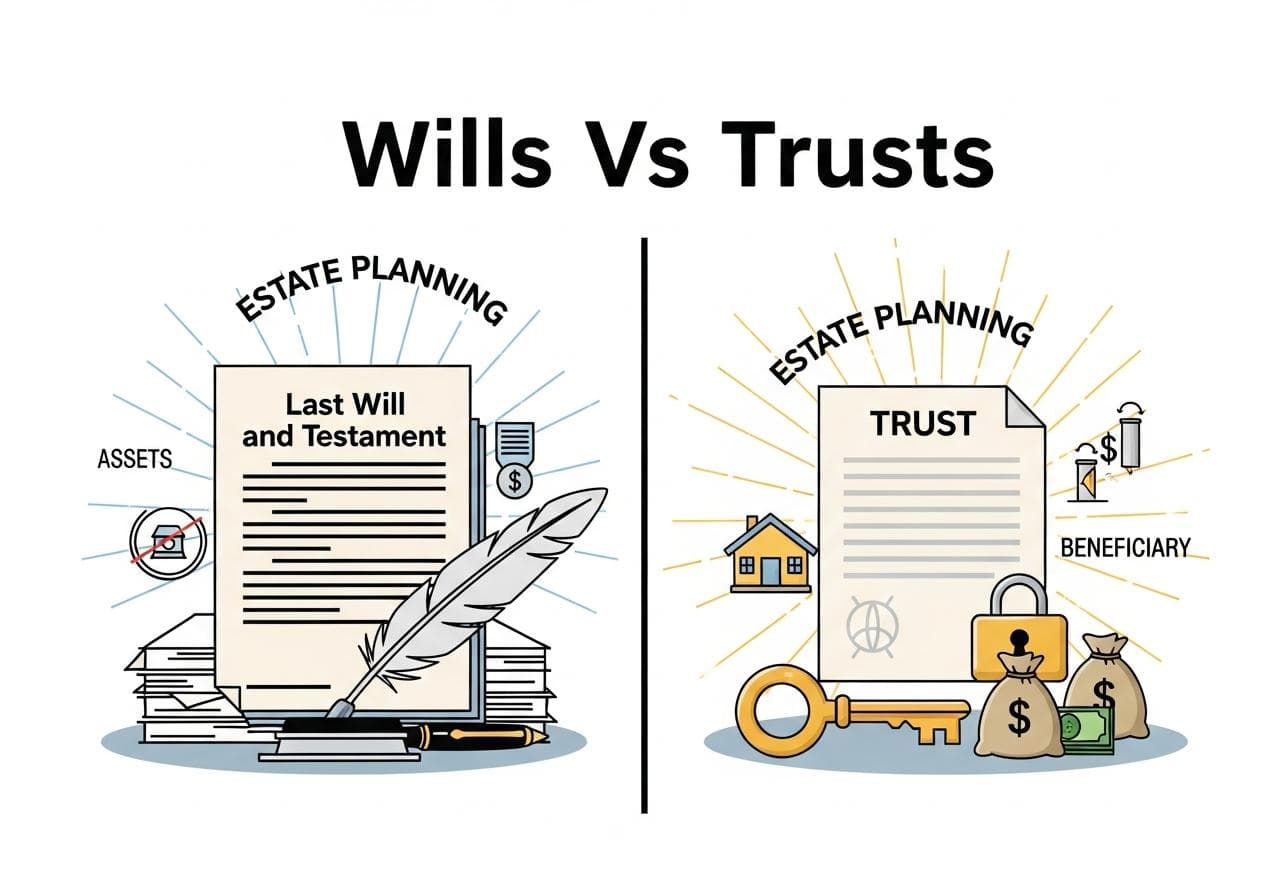

Wills Vs Trusts Key Differences

Estate planning involves distinct legal instruments. Wills distribute assets, while trusts offer management and privacy.

Research topics

Introduction to Estate Planning

Estate planning is a critical step in managing your assets and ensuring that your wishes are carried out after you're gone. Two primary tools in estate planning are wills and trusts. But how do they differ, especially when it comes to their implications on your tax implications? In this blog post, we’ll explore these key differences, diving into how each can impact your estate planning process.

Understanding Wills

A will is a legal document that expresses your wishes regarding the distribution of your assets after your death. It typically names an executor to manage your estate and includes details about your beneficiarys. One aspect many people are concerned about is the inheritance tax. Wills can be subject to this tax, depending on the value of the estate and the laws in your location.

The Role of Probate

One significant difference between wills and trusts lies in the probate process. A will must go through probate, a legal procedure that validates the will and oversees the distribution of assets. This can be a lengthy and expensive process, which may delay the transfer of your assets to your beneficiaries. On the other hand, trusts typically avoid probate, allowing for a faster and often less costly transfer.

Diving into Trusts

Trusts, in contrast, are legal entities that hold your assets for the benefit of your beneficiarys. There are various types of trusts, including revocable and irrevocable trusts, each with different implications for control, taxation, and asset protection. Importantly, trusts can offer specific benefits regarding tax implications and inheritance tax, potentially reducing the amount your beneficiaries owe.

Legal Advice: A Necessity for Both

Whether you choose a will or a trust, seeking legal advice is essential. An attorney specializing in estate planning can guide you based on your unique financial situation and family dynamics. This guidance is paramount for optimizing your estate plan and ensuring minimal tax implications for your heirs.

Financial Planning: The Bigger Picture

Estate planning should be viewed as part of your overall financial planning. Your decisions about wills, trusts, and potential tax implications have long-term effects on your financial legacy. A well-structured estate plan can help preserve your wealth and ensure your loved ones are taken care of according to your wishes.

Power of Attorney: More Than Just an Estate Tool

Another aspect to consider in your estate planning involves the use of a power of attorney. This document allows you to appoint someone to make financial or medical decisions on your behalf if you become incapacitated. This doesn't necessarily relate to wills and trusts, but it's a vital component of a comprehensive estate strategy.

Guardian Designations in Wills and Trusts

If you have minor children, one of the most crucial decisions is naming a guardian. Wills allow you to clearly designate a guardian for your children, giving you peace of mind about their future should something happen to you. In trusts, while securing assets for children, you might indirectly influence who would care for them, but direct guardianship is more clearly defined in a will.

The Tax Implications of Wills vs Trusts

When it comes to tax implications, understanding the differences between wills and trusts is essential. Wills can trigger estate taxes based on the total value of assets that pass through probate, while certain types of trusts can potentially shield assets from taxation, offering long-term financial benefits to beneficiaries.

Strategies for Minimizing Inheritance Tax

Utilizing strategies in both wills and trusts can help in minimizing inheritance tax. For instance, you can gift assets to heirs during your lifetime, thus reducing the taxable estate. Trusts, particularly irrevocable ones, can also be designed to help reduce estate taxes by removing assets from your taxable estate.

Choosing Between a Will and a Trust

The choice between a will and a trust often boils down to personal circumstances, including your financial situation and family needs. A will may be suitable for a simple estate, while a trust may be better for those with significant assets or complex family structures. It’s crucial to weigh the tax implications each option carries and how they align with your overall estate and financial planning.

Conclusion: Making Informed Decisions

In conclusion, understanding the key differences between wills and trusts is vital for effective estate planning. As we've discussed, each option has its benefits, drawbacks, and unique tax implications that can significantly affect how your assets are distributed after you're gone. For more detailed information, check out resources like the American Bar Association's Estate Planning, and consider seeking legal advice to tailor your estate strategy perfectly to your needs. Make informed decisions today to secure your loved ones' futures.

Additional Resources

If you are looking for further insights on estate planning, visit California Attorney General's website or explore Fidelity's estate planning basics for valuable guidance on managing your estate and understanding trusts and wills better.

Posts Relacionados

Aaa Renewal Online Guide

This guide provides a convenient, step-by-step process for online renewal.

Abogados De Accidentes Accident Attorneys

En el aftermath de un accidente, buscar representación legal de un abogado de accidentes calificado es esencial para proteger sus derechos

Accident Claim Specialists Your Rights

Understand your legal rights after an accident. Seek expert help to maximize your claim.